vermont income tax refund

After that youll be charged a 50 late filing penalty. Check My Refund Status Generally the Department processes e-filed returns in about 6-8 weeks while paper returns typically take about 8-12 weeks.

Individuals Department Of Taxes

You can also track your refund with the IRS mobile app IRS2Go.

. Wheres my Vermont tax refund. Then click Search to find your refund. E-filing your return and filing early can help ensure your refund.

Today the State Treasurer. May 12 2022 H510 - An act relating to a Vermont Child Tax Credit and the Vermont Social Security income exclusion Committee of Conference No committee of conference report found for H510 in the Regular. Taxpayers who e-file generally receive their refunds more quickly than those who file paper returns.

For e-filers nearly 74 of refunds last. If youve filed an. If you are a non-resident of Vermont but you earned more than 1000 from a source or.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a. COVID-19 Related Repayment Provisions. Contact State of Vermont Department of Taxes.

If you are a full or part-time resident of Vermont you earn more than 100 from a Vermont source or sources and you are required to a file a federal income tax return then you must also file a Vermont tax return. You can file your taxes up to 60 days after the federal tax filing deadline without incurring a penalty. Click on Check the Status of Your Return Personal Income Tax Return Status.

Feb 25 2022 IRS is in crisis Taxpayer Advocate warns. Property Tax Bill Overview. MONTPELIER Vt Today the Vermont Department of Taxes mailed 1099-G forms to 21000 taxpayers that detail potentially taxable state refunds or taxable grants.

Return processing begins on January 24. These forms are issued annually at the end of January to taxpayers who itemized deductions and received a Vermont income tax refund. Box 547 Montpelier VT 05601-0547.

There are five tax rate brackets. Before we refer a refund of 50 or more we send a notice by mail letting the taxpayer know that we are about to turn over the refund to. MONTPELIER VtThousands of working Vermonters are potentially missing out on a federal and state income tax credit that if claimed could result in a lower tax bill and a sizeable refund check.

That may make taxpayers nervous about delays in 2022 but most Americans should get their refunds within 21. Check the status of your Vermont refund using these resources. Returns are held until the Department receives W-2 withholding reports from employers which are due on Feb.

If you still have questions about your state tax refund contact the Vermont Department of Taxes Individual Income Tax Division. We refer unclaimed refunds meeting certain requirements to the Unclaimed Property Division of the Vermont State Treasurers Office. Please wait at least three days before checking the status of your return on electronically filed returns.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Last tax season more than 45000 Vermonters claimed the federal and state Earned Income Tax Credit or EITC for a combined average refund of more than 2000. The Department will begin processing returns in February.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. SOLVED by TurboTax 516 Updated January 20 2022.

This year taxpayers who received an Economic Recovery Grant. Pay Estimated Income Tax by Voucher. The most efficient and secure way to file Vermont tax returns continues to be electronic filing and direct deposit to an existing bank account is the fastest way to receive a refund.

As much as we would like to help TurboTax does not distribute refunds only the IRS or your state tax agency can legally do so. About 28 billion dollars from individual income tax payments is added to Vermonts general fund every year. Every year the Vermont Department of Taxes reviews our files to find unclaimed refunds from the prior year.

If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO. EFileIT October 15 2022 October 17 2022 via mail-in Forms. The state has one of the highest individual tax rates in the nation.

To check the status of your Vermont state refund online follow these steps. Pay Estimated Income Tax Online. Do I Need to File a Vermont State Tax Return.

2014 Estimated Payments including any extension payment and carryforward amount. Department of Taxes Check Return or Refund Status No. For sale or wanted in setx.

31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. You will be prompted to enter. 33 rows When you file a Vermont income tax return you will need a statement from your.

ID type SSNITIN ID number. Current Year Income Tax Return andor Renter Rebate Claim. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

You can also track your Vermont tax refund after you file your taxes to find out when you will get. Processing Time and Refund Information. If you cant file your Vermont income tax return by April 15 you can apply for a six-month extension through myVTax online or by mailing Form IN-151 Application for Extension of Time to File.

If you file a paper return it usually takes about 3 to 4 weeks to get your refund. You can only e-File to file by paper see below Vermont Income Tax Return together with an IRS Tax Return. Box 1881 Montpelier Vermont 05601-1881.

Vermont State Tax Refund Status Information For returns filed by paper Allow up to 8 weeks for processing time Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund Checks can be cashed up to 180 days after the issue date. State of Vermont Tax Refund Info. 802 828-2551 option 3.

If you e-file you will usually get your refund in 7 to 10 days.

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Paying Taxes Is On Everyone S Mind Rarely In A Good Way Knowing Some Pithy Facts About Our Tax Syste How To Create Infographics Surprising Facts Paying Taxes

Where S My Refund Vermont H R Block

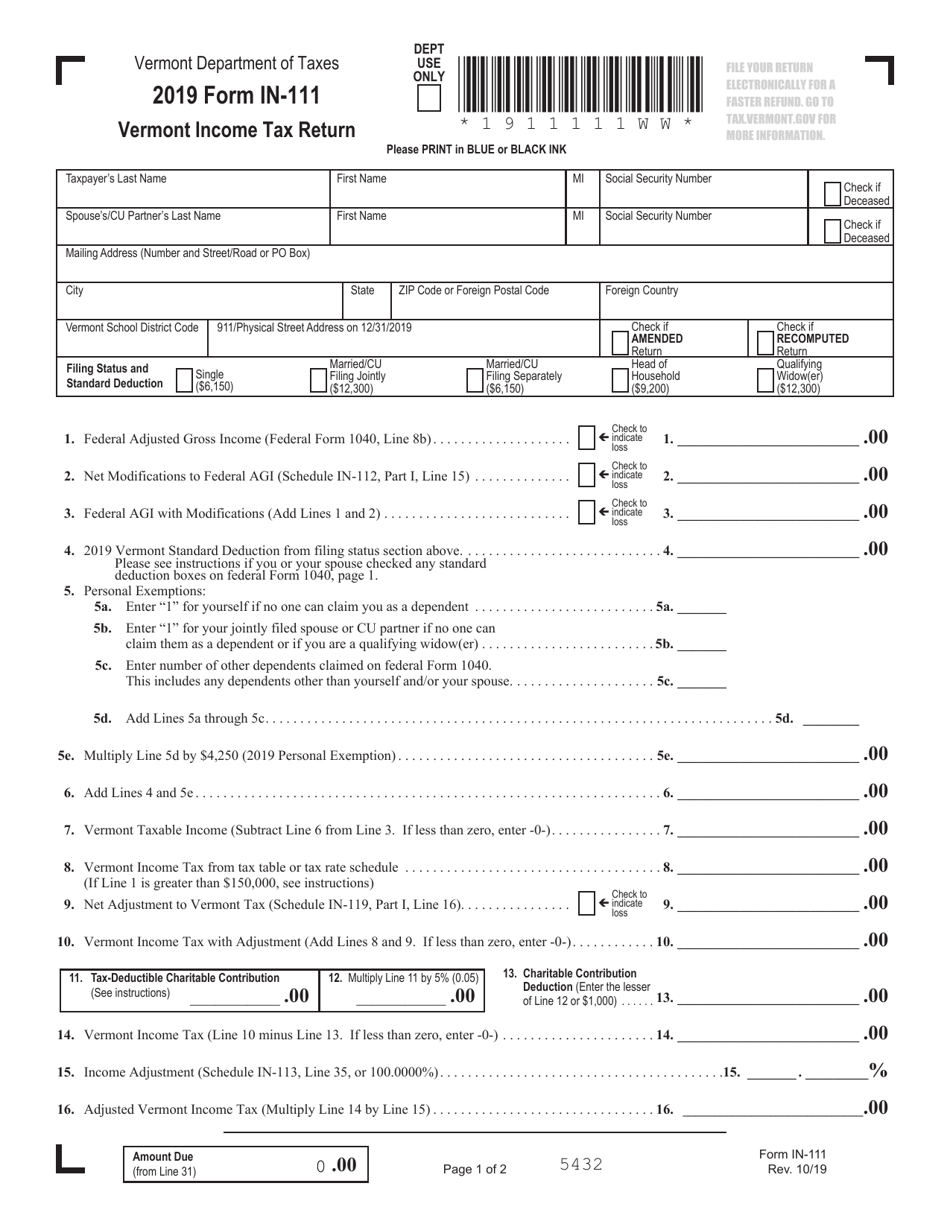

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Personal Income Tax Department Of Taxes

Vermont Department Of Taxes Facebook

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Personal Income Tax Department Of Taxes

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Department Of Taxes Facebook

Vermont Income Tax Vt State Tax Calculator Community Tax

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Complete And E File Your 2021 2022 Vermont State Tax Return

Vermont Tax Forms And Instructions For 2021 Form In 111

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine