stock option tax calculator uk

Exercising your non-qualified stock options triggers a tax. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

How To Calculate Equity Value Equity Ipo Guide Wealthfront

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

. Only for employees tax favored treatment which is as low as 10 percent if the option is held for two. Alice now has a tax liability on the 25000 worth of stock which is taxed at the ordinary income rate. While if you hold that property or stock.

NSO Tax Occasion 1 - At Exercise. Nonqualified Stock Options NSOs are common at both start-ups and well established companies. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

On this page is an Incentive Stock Options or ISO calculator. This calculator illustrates the tax benefits of exercising your stock options before IPO. The Stock Option Plan specifies the total number of shares in the option pool.

The Stock Option Plan specifies the total number of shares in the option pool. Non-tax favored Options UK ISO US. When the option is exercised the option gain is subject to income tax up to 45 in the uk and 37 in the us.

The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income. Restricted Stock UK Summary. Learn to Trade XSP Today.

Nonqualified Stock Option NSO Tax Calculator. You can deduct certain costs of buying or selling your shares from your gain. Enter the number of shares purchased.

If the scheme is unapproved then any money you. Per IRS Topic 409 if you trade in. Options granted under an employee stock purchase plan or an incentive stock option iso plan are statutory stock options.

Fees for example stockbrokers fees. Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21. Lets say you got a grant price of 20 per share but when you exercise your.

Stock option tax calculator uk Friday May 6 2022 Edit. The Stock Calculator is very simple to use. There are two types of stock options.

Open an Account Now. Enter the purchase price per share the selling price per share. Taxes for Non-Qualified Stock Options.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Please enter your option information below to see your potential savings. Just follow the 5 easy steps below.

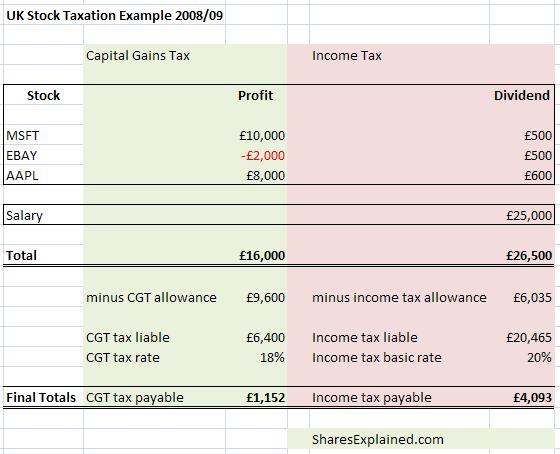

Stamp Duty Reserve Tax SDRT when you. In particular stock trading tax in the UK is more straightforward. The 42 best stock option tax.

Short-term and long-term capital gains tax. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent.

Uk Investment Tax For Employees Selling Rsus Taxscouts

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Rsu Taxes Explained 4 Tax Strategies For 2022

Option Exercise Calculator Liquid Stock

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

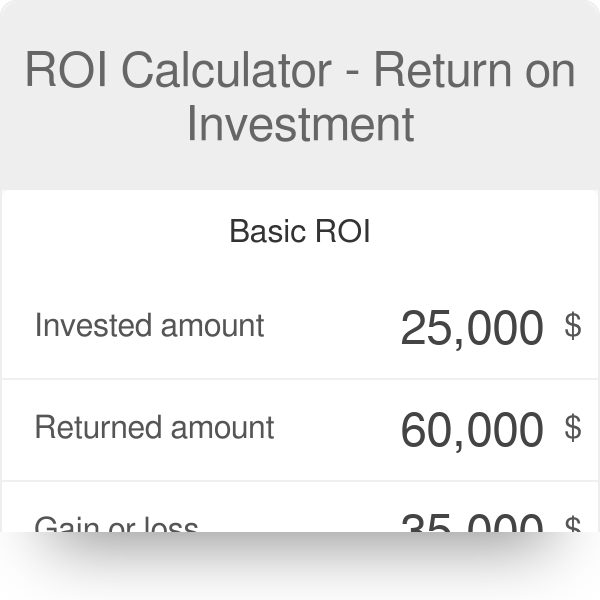

Roi Calculator Check Roi On Your Investment

Capital Gains Github Topics Github

Incentive Stock Options Turbotax Tax Tips Videos

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

![]()

Uktaxcalculators World Tax Calculator And Take Home Comparison Uk Tax Calculators

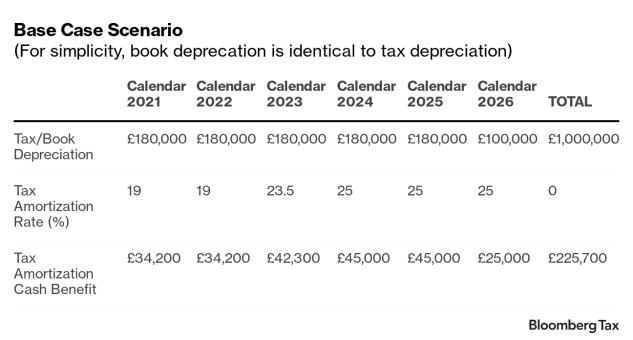

U K Super Tax Deduction Tax Accounting Impact Part 2

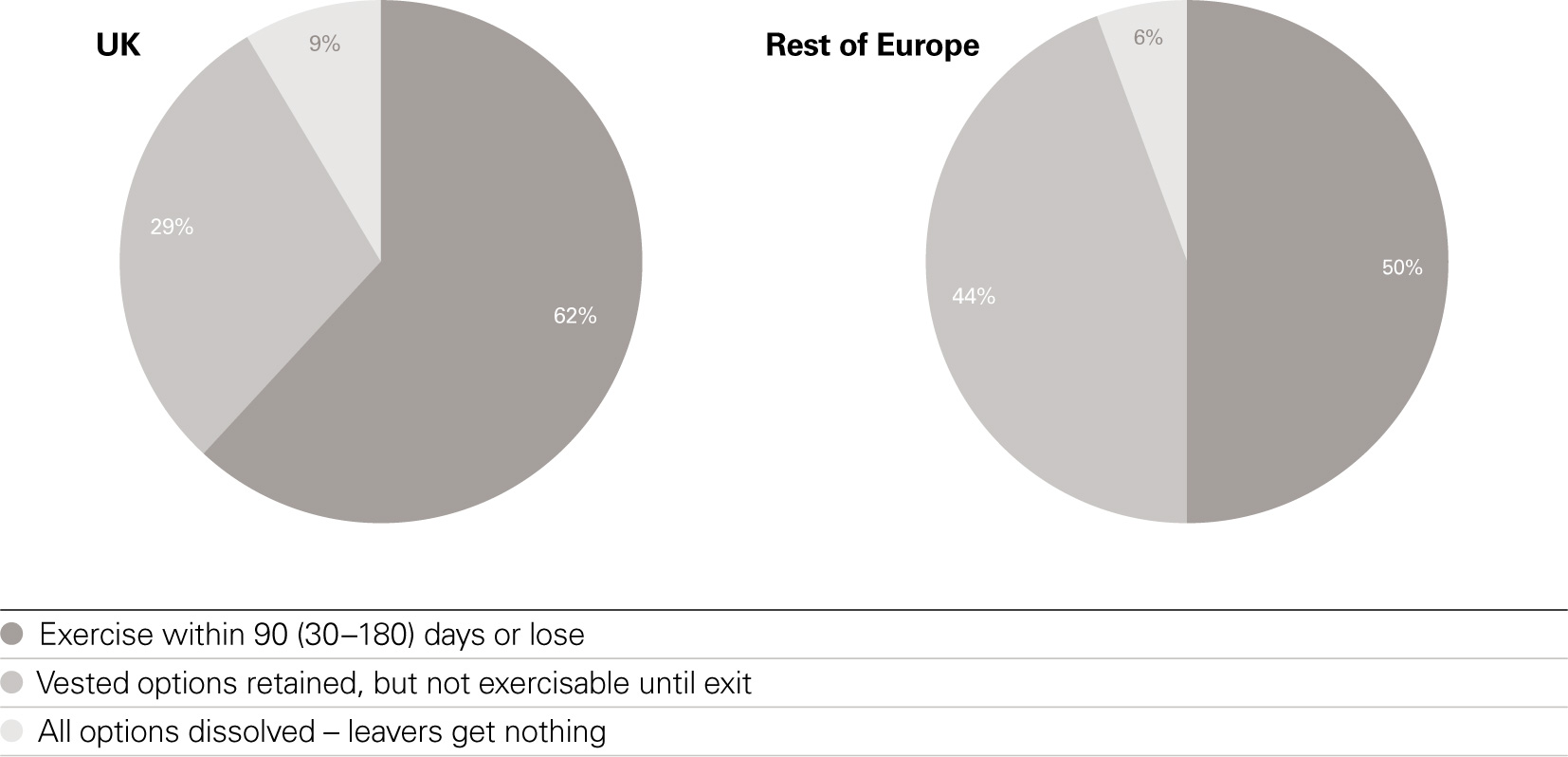

Taxes On Equity Compensation The Holloway Guide To Equity Compensation

Capital Gains Tax Help Trading 212 Community

16 Ways To Reduce Stock Option Taxes

Mytools Track Your Options Portfolio Calculate Return On Investment And Model Your Net Gains Mystockoptions Com

Restricted Stock Units Jane Financial

Rewarding Talent Index Ventures